Salary

Last modified:

✅How to Configure Salary Calculation Schemes in DIKIDI

Salary setup and calculation are located in the Salary section and are designed to automate the calculation of staff salaries. All calculations are made on the basis of data from registered sales in your company and pre-configured calculation schemes.

In the DIKIDI platform you can customize a salary scheme individually for each employee on any position.

Setting up Staff's salary schemes

- Percentage of own sales

- Percentage of company sales

- Percentage of appointments made

- Fixed payment

- Guaranteed payment

Percentage of own sales

The Percentage of own sales salary scheme is most often used for specialists, as well as for administrators who sell products. The percentage of employee sales (who is a seller of goods or services provider) is used in this scheme.

Percentage can be the same for all services or goods. And there is also a flexible percentage setting for each individual service. Including in the form of a fixed amount.

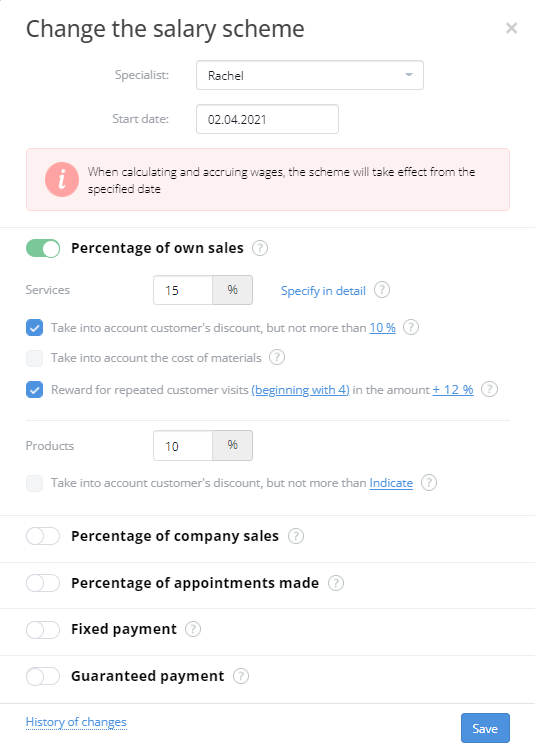

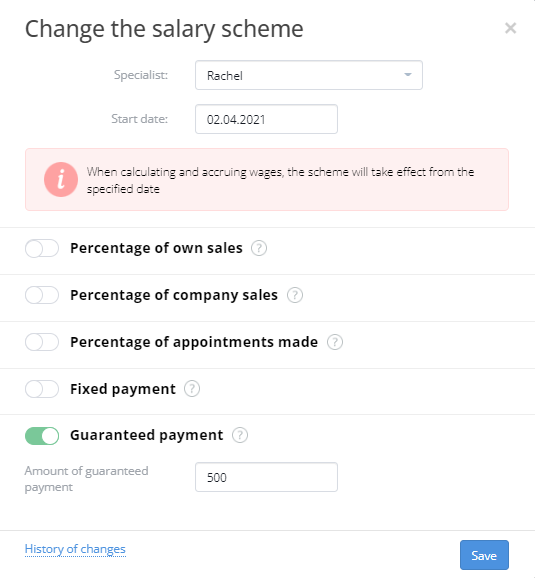

In the window that opens, select the employee for whom this scheme will apply, and the date from which his salary will be calculated according to the scheme. Enter percentage for services and goods.

If an employee receives a different percentage from different services or a fixed rate is set for the sale of a service, click Specify in detail to set up his payroll. In the window that opens, enter information on percentage and rates next to each service.

Take into account customer's discount, but not more than. This setting allows you to limit the discount that is considered when calculating the salary of an employee. For example, a customer was given a 30% discount on a service. At the same time, there is an agreement with a specialist that the maximum discount that he can provide is 10%. Thus, by setting this restriction "Take into account the discount but not more than 10%", a specialist will lose only 10% of revenue, and a company the remaining 20%.

Take into account the cost of materials. If your specialist receives a salary only from his work (excluding materials spent on the provision of services), you must enable the "Take into account the cost of materials." parameter. For example, a hairdresser provides hair coloring services. The cost of selling this service was 3,000. Of these, 2,000 were materials and 1,000 were labor. With this option, the specialist’s salary will be calculated exactly as % from 1000.

Reward for repeated customer visits. You can enable this option to charge an additional percentage to the specialist to whom customers return for visits. You need to set percentage and number of repeat visits from which the countdown for the reward will begin.

Percentage of company sales

For some types of work positions, there is a payroll scheme where an employee receives a percentage of company's total revenue.

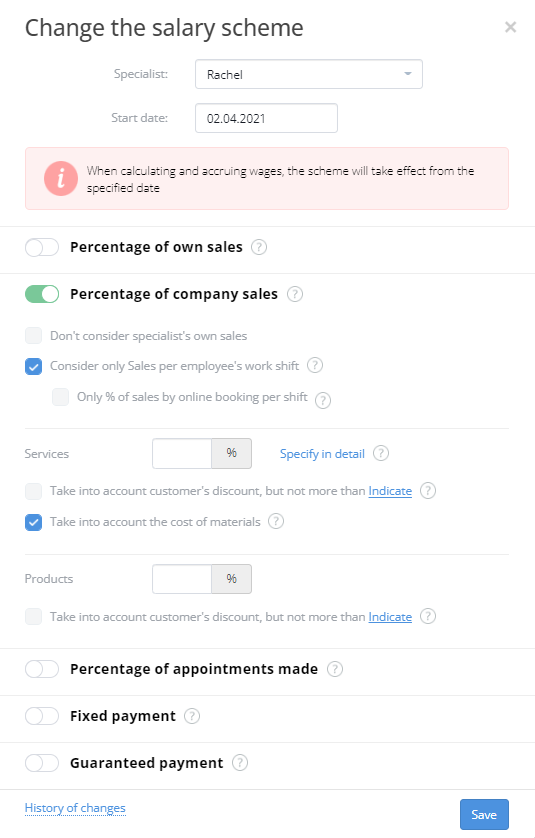

In the scheme setup, enable the Percentage of company sales switcher. Below you will be asked to clarify the details of this setting and percentage on goods and services.

Don't consider specialist's own sales. If an employee's salary scheme includes a percentage of their own sales, and plus the employee receives a percentage of company's total revenue, then it must be understood that in this case, this employee can receive a percentage of his sales revenue twice. To prevent this from happening, connect the specified function.

Consider only Sales per employee's work shift. In order for an employee to receive a percentage of company's sales, but only from those made on his shift, enable this setting.

Take into account customer's discount, but no more than. Take into account the cost of materials. These parameters is described in the paragraph "Percentage of own sales".

Percentage of appointments made

With this scheme, you can reward any employee for attracting new customers and creating appointments.

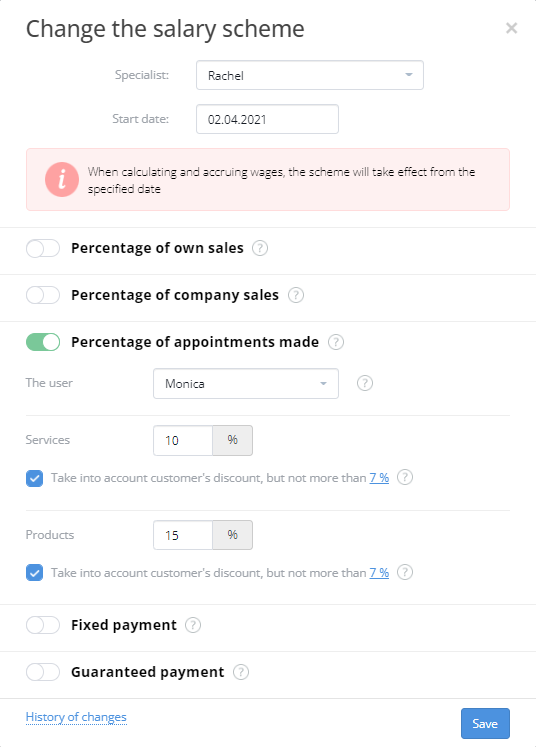

Specify the User on whose behalf the appointments will be created, and indicate the percentage that will be charged to him.

Set the Take into account the discount, but no more than parameter — it was described earlier.

Fixed payment

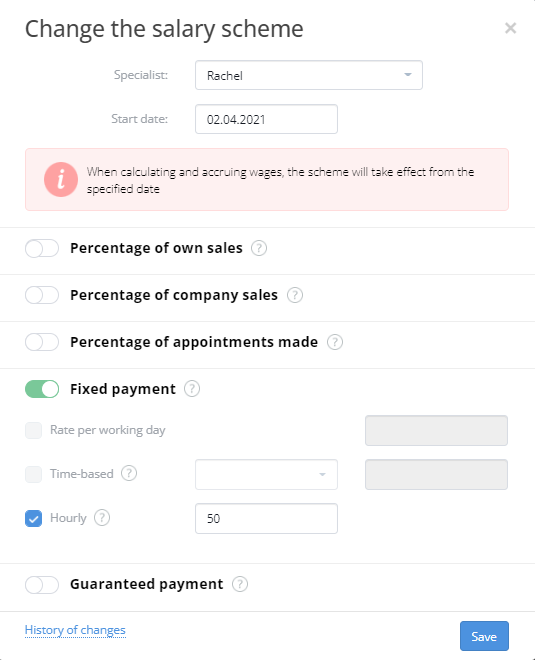

It's most often used for employees with time-based / hourly pay or rate per working day. Select the Fixed payment setup option to consider employee's working time.If an employee receives a salary per working day, then enable the Rate per working day option.

If an employee has a fixed rate not for the entire working day, but only for the time when he directly provided services, then select the Time-based or Hourly option. Select the time unit and its cost.

Guaranteed payment

Often companies need to establish a guaranteed salary, for example, for a specialist who has recently got a job.

Connect the Guaranteed payment salary scheme by clicking on a switcher, and enter the amount of guaranteed payment. It will be paid to an employee if the amount of all percentage payments is less than the guaranteed one.

Since this salary scheme directly depends on the percentage based on the results of employee's work, it is additionally necessary to set one of the following schemes: Percentage of own sales, Percentage of company sales, Percentage of appointments made.

Example. A specialist has a percentage of sales set at 10%, and a guaranteed salary of 30,000 conv. units. In April, the percentage of sales received by an employee amounted to 20,000 conv. units. Thus, at the end of the month, he will be paid a salary of 30,000 conv. units.

If you want to pay salaries regardless of the sales factor, we recommend that you set up Fixed Payment only.

The Salary functionality is available in the paid plans Minimum, Standard and Full, you can also connect this module separately.